What Is Section 179 Limit For 2024

What Is Section 179 Limit For 2024. In 2024, the section 179 deduction limit has been raised to $1,220,000 (an increase of $60,000 from 2023). A section 179 expense is a business asset that can be written off for tax purposes right away rather than being depreciated over time.

Under § 179(b)(2), the $1,220,000 limitation under § 179(b)(1) is reduced (but not below zero) by the amount by which the cost of § 179 property placed in service during the. Section 179 of the tax code allows businesses to deduct up to 100% of the purchase price of qualifying equipment and/or software placed in service during the tax year.

Section 179 Of The Tax Code Allows Businesses To Deduct Up To 100% Of The Purchase Price Of Qualifying Equipment And/Or Software Placed In Service During The Tax Year.

For 2023, the deduction limit is us$1,160,000 if you purchase $2.89 million or less of trucks or equipment.

An Entity That Places More Than $2,890,000 Of Property In Service During The Tax Year Will See Its.

In 2024, the section 179 deduction limit has been raised to $1,220,000 ( an increase of $60,000 from 2023 ).

For Tax Years Beginning In 2024, Businesses Can Potentially Write Off Up To $1,220,000 Of Qualified Asset Additions In Year One (Up From.

Images References :

Source: www.netsapiens.com

Source: www.netsapiens.com

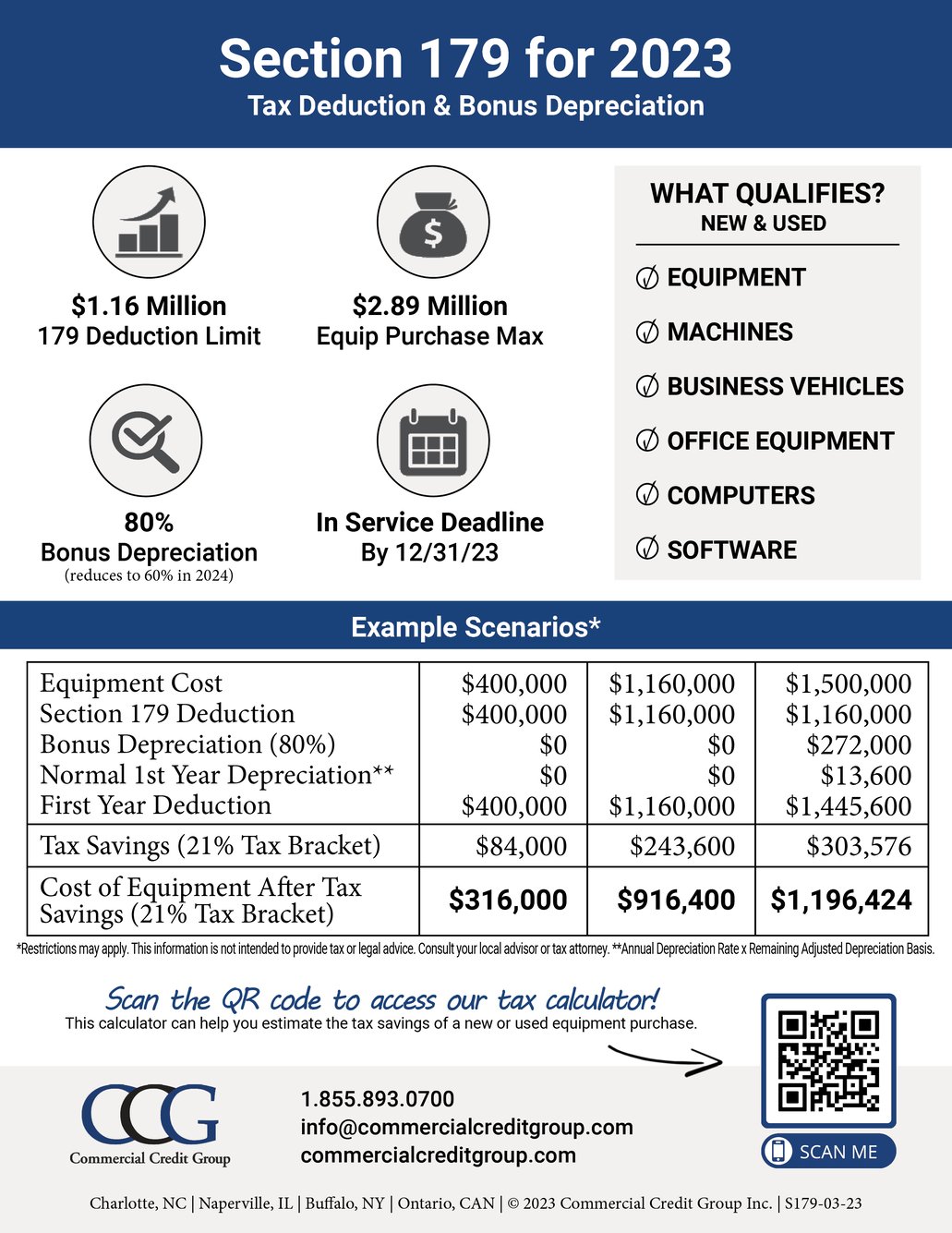

Section 179 IRS Tax Deduction Updated for 2023, Companies can deduct the full purchase price of all. An entity that places more than $2,890,000 of property in service during the tax year will see its.

Source: www.commercialcreditgroup.com

Source: www.commercialcreditgroup.com

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions, In contrast, bonus depreciation is limited to 80 percent for 2023 (60 percent for 2024). In 2024, the section 179 deduction limit has been raised to $1,220,000 (an increase of $60,000 from 2023).

Source: clarkcapitalfunds.com

Source: clarkcapitalfunds.com

Section 179, Companies can deduct the full purchase price of all. In contrast, bonus depreciation is limited to 80 percent for 2023 (60 percent for 2024).

Source: www.bestpack.com

Source: www.bestpack.com

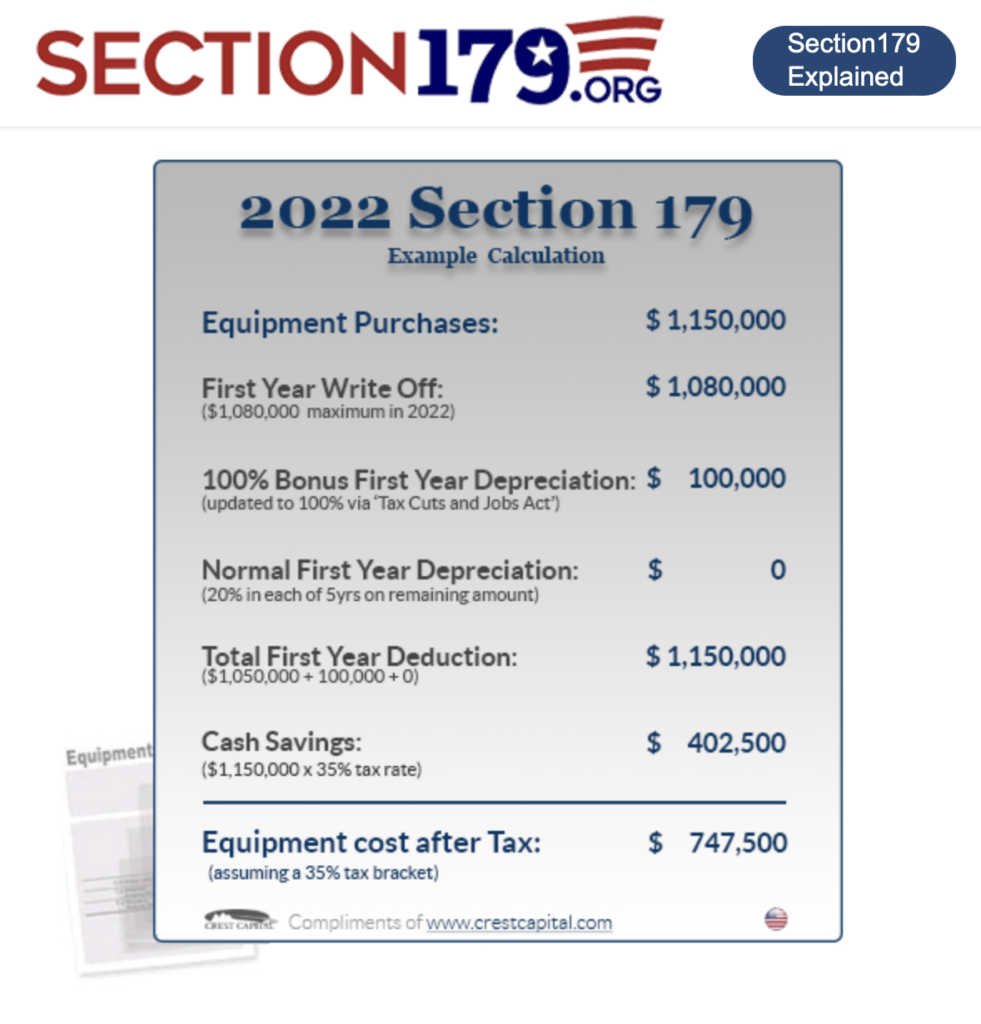

Section 179 in 2022 BestPackBestPack, To calculate the maximum amount for a section 179 deduction in 2024, a business should first determine the total cost of all the qualifying equipment purchased in the year. For 2023, the section 179 deduction limit is $1,160,000.

Source: blog.burkett.com

Source: blog.burkett.com

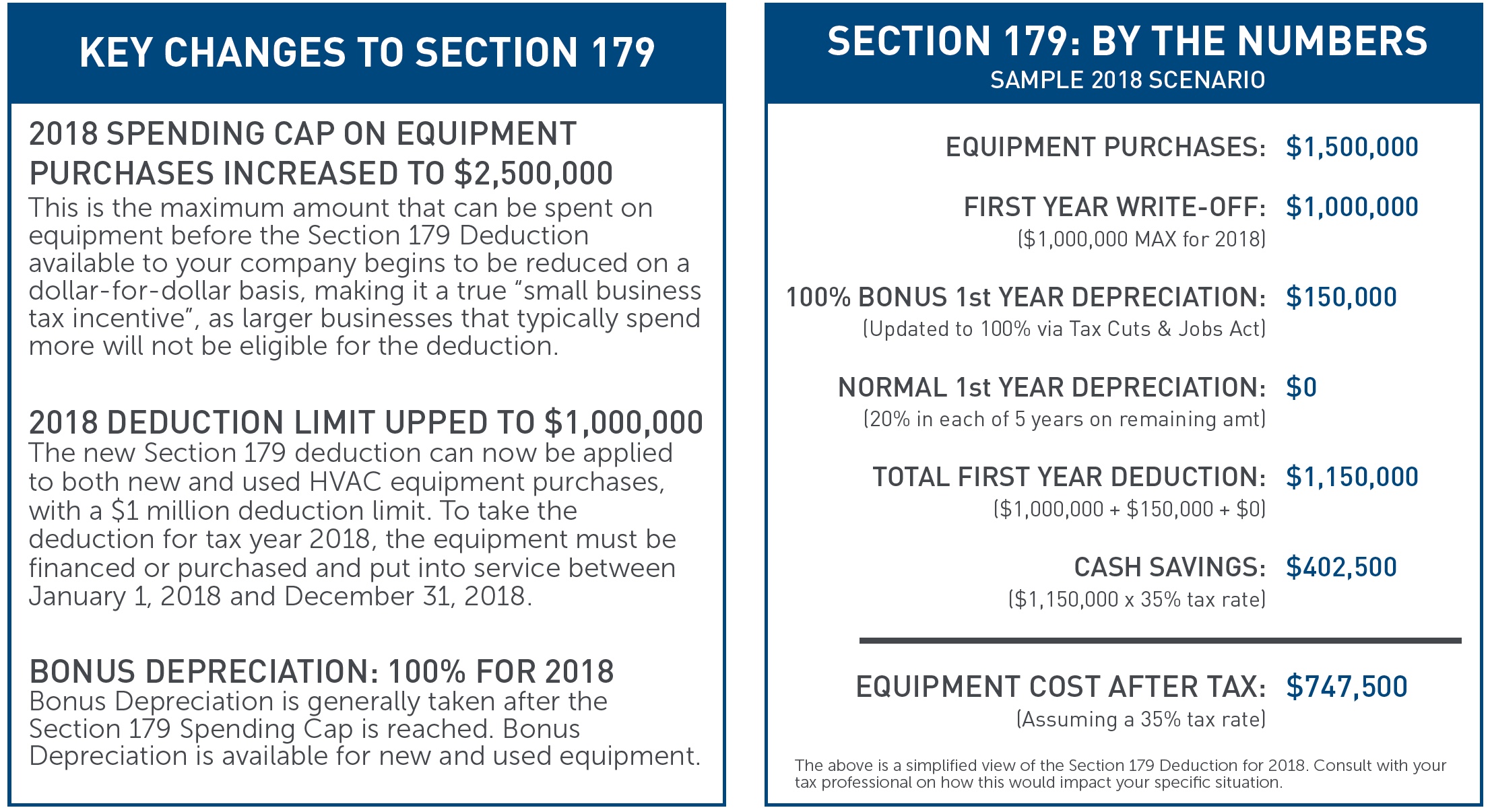

What is Section 179 of the IRS Tax Code? The Burkett Blog, The section 179 deduction limit for 2024 was raised to $1,220,000 with a capital purchase limit of $3,050,000. The section 179 deduction is a tax incentive that is designed to encourage businesses to invest in their own growth.

Source: airforceone.com

Source: airforceone.com

CHANGES TO IRS SECTION 179 WHAT IT MEANS FOR FACILITY OWNERS Air, Under § 179(b)(2), the $1,220,000 limitation under § 179(b)(1) is reduced (but not below zero) by the amount by which the cost of § 179 property placed in service during the. This means your business can now deduct the entire cost of.

Source: providencecapitalfunding.com

Source: providencecapitalfunding.com

All About Section 179 Infographic Providence Capital Funding, Bureau of east asian and pacific affairs. For tax years beginning in 2024, businesses can potentially write off up to $1,220,000 of qualified asset additions in year one (up from.

Source: vermeerallroads.com

Source: vermeerallroads.com

Section 179 Tax Deduction, This means your business can now deduct the entire cost of. For 2023, the section 179 deduction limit is $1,160,000.

Source: gpstrackit.com

Source: gpstrackit.com

The Ultimate Fleet Tax Guide Section 179 GPS Trackit, Under § 179(b)(2), the $1,220,000 limitation under § 179(b)(1) is reduced (but not below zero) by the amount by which the cost of § 179 property placed in service during the. In 2023 (taxes filed in 2024), the maximum section.

Source: boxwell.co

Source: boxwell.co

Section 179 Tax Benefit for Relocatable Storage Units Boxwell, The section 179 deduction limit for 2024 was raised to $1,220,000 with a capital purchase limit of $3,050,000. It may be good to know that there is the section 179.

An Entity That Places More Than $2,890,000 Of Property In Service During The Tax Year Will See Its.

Under § 179(b)(2), the $1,220,000 limitation under § 179(b)(1) is reduced (but not below zero) by the amount by which the cost of § 179 property placed in service during the.

Section 1256 Of The John S.

In 2024, the section 179 deduction limit has been raised to $1,220,000 ( an increase of $60,000 from 2023 ).